Skillz Reports Record Q2 Revenue and Updates 2021 Guidance

– 22nd Consecutive Quarter of Growth

– Company Completes Aarki Acquisition and Investment in Exit Games in July

– Updates Organic Revenue Guidance Up to $376 Million

Skillz Inc. (NYSE: SKLZ) (“Skillz” or the “Company”), the leading mobile games platform bringing fair competition to players worldwide, today announced financial results for the second quarter ended June 30, 2021.

“Skillz is pleased to report strong revenue growth for the 22nd consecutive quarter and the closing of our acquisition of marketing platform Aarki, which will increase the efficiency of our user acquisition spend,” said Andrew Paradise, CEO and founder of Skillz. “Together with our partners, we continue to accelerate our vision of connecting the world through the power of competition.”

Q2 Financial Highlights

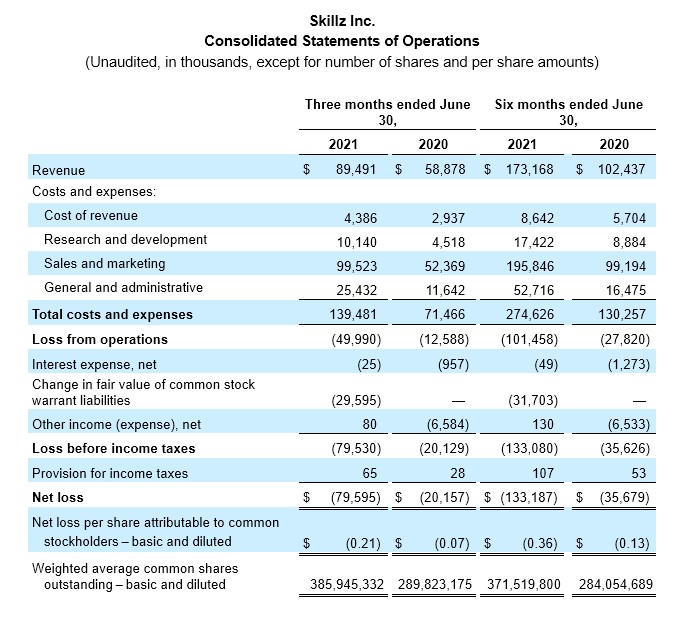

- Revenue grew to $89.5 million during the second quarter of 2021, up 52% over the prior year.

- Gross profit grew to $85.1 million during the second quarter of 2021, up 52% over the prior year.

- Gross margin was 95% during the second quarter of 2021, in line with prior year.

- Net loss increased to $79.6 million during the second quarter of 2021, compared with $20.2 million in the prior year.

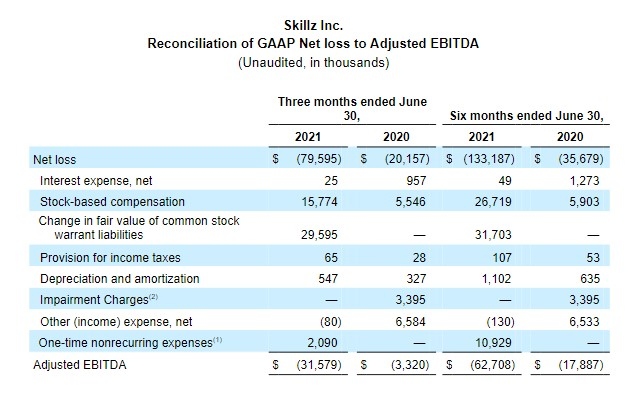

- Adjusted EBITDA was $(31.6) million during the second quarter of 2021, $28.3 million lower than the prior year.

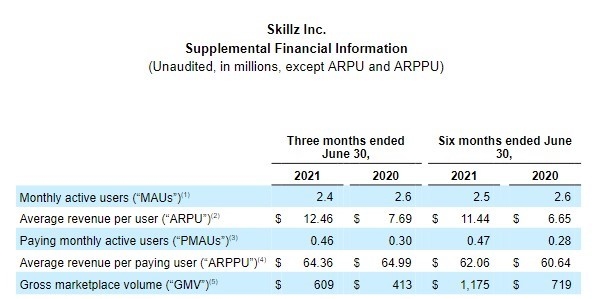

- Gross Marketplace Volume1 (GMV) grew to $608.5 million during the second quarter of 2021, up 47% over the prior year.

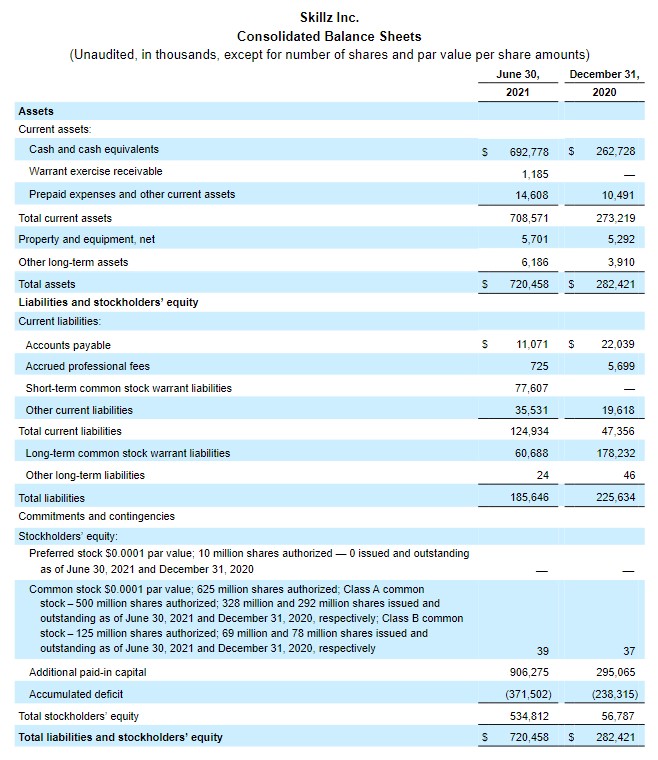

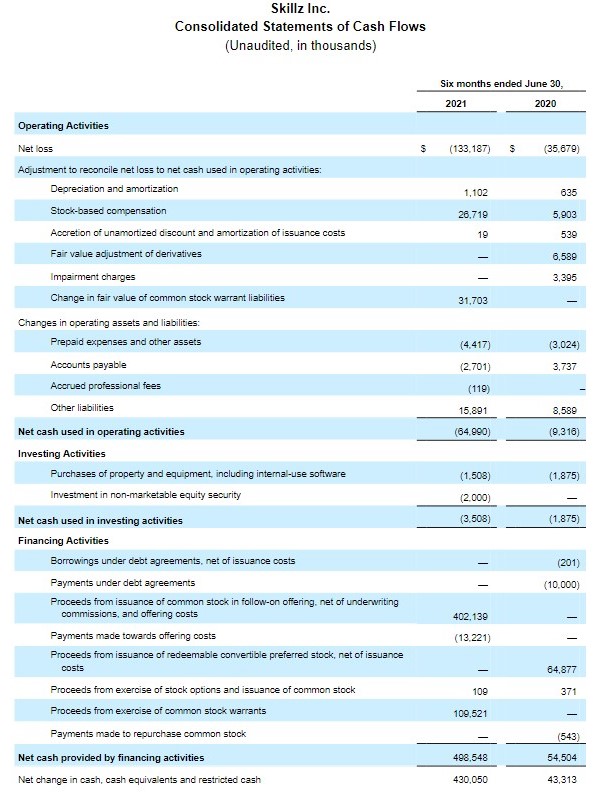

- Cash on balance sheet of $692.8 million and no debt at the end of second quarter 2021.

| 1 Gross Marketplace Volume means the total entry fees paid by users for contests hosted on Skillz’s platform. Total entry fees include entry fees paid by end-users using cash deposits, prior cash winnings from end-users’ accounts that have not been withdrawn, and end-user incentives used to enter paid entry fee contests. |

Q2 Business Highlights

- Acquired Aarki, a growing demand-side platform with more than 465 million monthly users, rich data engines, and proprietary machine-learning algorithms that deliver industry-leading ROI to its advertiser customers. Aarki broadens Skillz’s footprint by combining Skillz’s leading monetization with Aarki’s advanced User Acquisition capabilities.

- Formed a strategic alliance with Exit Games, a private German company whose advanced technology allows developers to create and host real-time, synchronous, multiplayer games. Skillz’s $50 million investment for a minority stake in Exit Games will give the Company permanent access to Exit’s technology to power its esports tournaments and platform exclusively, as well as dramatically accelerate the development of multiplayer synchronous content on the Skillz platform.

- Officially launched our multi-phase partnership with the NFL, kicking off a developer challenge to identify new NFL-branded mobile game(s). Hundreds of game proposals were submitted, and in collaboration with the NFL, Skillz reviewed the concepts and selected 14 semi-finalists, who have moved into the development phase of the competition.

- Launched Big Buck Hunter: Marksman, successfully advancing the mobile version of the legendary arcade game through the first phase of scale testing. Skillz continues to work to optimize performance in preparation for scaling.

Financial Outlook

The Company is updating its full-year 2021 revenue guidance from $375 million to $376 million for Skillz on a stand-alone basis, plus $13 million revenue contribution from the business combination with Aarki resulting in combined 2021 revenue of $389 million.

Investor Conference Call and Webcast

Earlier today, Skillz posted a stockholder letter and short video featuring Andrew Paradise, Founder and CEO at Skillz, discussing the second quarter results on its investor relations website at http://investors.skillz.com. A live question and answer conference call and audio webcast with analysts and investors will begin at 5:30pm Eastern Time (ET).

The Q&A conference call can be accessed by registering online for the Skillz Conference, at which time registrants will receive dial-in information as well as a passcode and registrant ID. At the time of the call, participants will dial in using the numbers in the confirmation email and enter their passcode and ID, upon which they will enter the conference call. Registration to a live audio-webcast of the discussion in listen-only mode is available at webcast registration.

A replay of the webcast will be archived on the Company’s investor relations website. An audio replay of the Q&A conference call will be available through August 10, 2021 and can be accessed by dialing 1-929-458-6194 (domestic) or +44-204-525-0658 (international) and entering the passcode 684073.

About Skillz Inc.

Skillz is the leading mobile games platform that connects players in fair, fun, and meaningful competition. The Skillz platform helps developers build multi-million dollar franchises by enabling social competition in their games. Leveraging its patented technology, Skillz hosts billions of casual esports tournaments for millions of mobile players worldwide, and distributes millions in prizes each month. Skillz has earned recognition as one of Fast Company’s Most Innovative Companies, CNBC’s Disruptor 50, Forbes’ Next Billion-Dollar Startups, and the #1 fastest-growing company in America on the Inc. 5000. www.skillz.com

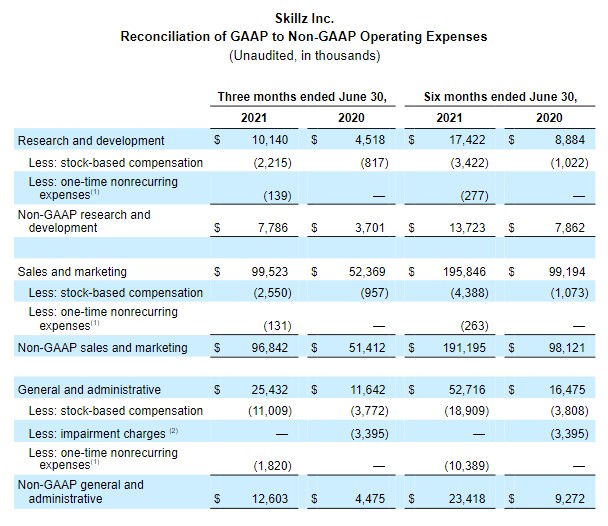

Use of Non-GAAP Financial Measures

In this press release, the Company includes Adjusted EBITDA and Non-GAAP Operating Expenses, which are non-GAAP performance measures that the Company uses to supplement its results presented in accordance with U.S. GAAP. As required by the rules of the Securities and Exchange Commission (“SEC”), the Company has provided herein a reconciliation of the non-GAAP financial measures contained in this press release to the most directly comparable measures under GAAP. The Company’s management believes Adjusted EBITDA and Non-GAAP Operating Expenses are useful in evaluating its operating performance and are similar measures reported by publicly-listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s profitability for the periods presented. Adjusted EBITDA is not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. Further, Non-GAAP Operating Expenses is not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

The Company defines and calculates Adjusted EBITDA as net loss before interest, other non-operating expense or income, provision for income taxes, and depreciation and amortization, and further adjusted for stock-based compensation and other special items determined by management, including, but not limited to, fair value adjustments for certain financial liabilities (including derivatives) associated with debt and equity transactions and impairment charges, as they are not indicative of business operations. The Company defines and calculates Non-GAAP Operating Expenses as GAAP Operating Expenses adjusted for stock-based compensation, one-time transaction expenses and other special items determined by management, including, but not limited to impairment charges, as they are not indicative of business operations.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The Company’s actual results may differ from its expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements.

These forward-looking statements involve significant risks and uncertainties that could cause the Company’s actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside of the Company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to, the ability of Skillz to: effectively compete in the global entertainment and gaming industries; attract and retain successful relationships with the third party developers that develop and update all of the games hosted on Skillz’s platform; comply with laws and regulations applicable to its business; and as well as other risks and uncertainties indicated from time to time in the Company’s SEC filings, including those under “Risk Factors” therein, which are available on the SEC’s website at www.sec.gov. Additional information will be made available in other filings that the Company makes from time to time with the SEC. In addition, any forward-looking statements contained in this press release are based on assumptions that the Company believes to be reasonable as of this date. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

(1) For the three and six months ended June 30, 2021, amounts represent one-time nonrecurring expenses related to the follow-on offering, Aarki acquisition, and executive severance expense.

(2) For the three and six months ended June 30, 2020, amounts represent an impairment charge of a lease deposit and prepayment in connection with a lease agreement related to our facilities in San Francisco.

(1) For the three and six months ended June 30, 2021, amounts represent one-time nonrecurring expenses related to the follow-on offering, Aarki acquisition, and executive severance expense.

(2) For the three and six months ended June 30, 2020, amounts represent an impairment charge of a lease deposit and prepayment in connection with a lease agreement related to our facilities in San Francisco.

(1) “Monthly Active Users” or “MAUs” means the number of end-users who entered into a paid or free contest hosted on Skillz’s platform at least once in a month, averaged over each month in the period.

(2) “Paying Monthly Active Users” or “PMAUs” means the number of end-users who entered into a paid contest hosted on Skillz’s platform at least once in a month, averaged over each month in the period.

(3) “Average Revenue Per Monthly Active User” or “ARPU” means the average revenue in a given month divided by MAUs in that month, averaged over the period.

(4) “Average Revenue Per Paying Monthly Active User” or “ARPPU” means the average revenue in a given month divided by Paying MAUs in that month, averaged over the period.

(5) “GMV” or “Gross Marketplace Volume” means the total entry fees paid by users for contests hosted on Skillz’s platform. Total entry fees include entry fees paid by end-users using cash deposits, prior cash winnings from end-users’ accounts that have not been withdrawn, and end-user incentives used to enter paid entry fee contests.

Contacts:

Investors: ir@skillz.com

Media: pr@skillz.com